PART 1: Genesis Block

Soona Amhaz discovered bitcoin while she was an engineering student at the University of Michigan. Today, she is a co-founder and partner at Volt Capital. You can follow her on Twitter @soonaorlater.

On Value

How much is a life vest worth?

It can be any size or hue

Costs around 15 bucks

Give or take a few.

Now picture yourself in a flood.

The tag has a different price:

Everything you’ve ever owned

In your entire life.

The thing about value is

It changes with each new dawn.

Sometimes we see it coming;

Sometimes it’s a black swan.

So, when we talk about market forces

That’ll make bitcoin the norm,

It’s truly no coincidence

We call it The Perfect Storm.

Introduction

This a book by cypherpunks about bitcoin

There are already so many amazing books about bitcoin, ranging from Jimmy Song’s Programming Bitcoin to Mastering Bitcoin by Andreas Antonopoulos, The Bitcoin Standard by Saifedean Ammous and The Little Bitcoin Book by the Bitcoin Collective (including Alena Vranova, who contributed to this anthology as well). These books explain bitcoin’s technical and economic properties so elegantly that we won’t attempt to rehash an introduction to bitcoin.

Instead, this collection aims to complement those narratives by adding more personal perspectives to the shared saga. This book is not a definitive word on any subject. It is about the stories we tell in private. It is a mosaic that explores what we imagine when we talk about bitcoin.

This book explores the notion that bitcoin has become much more than software itself. It grapples with this central question: “Does a bitcoin culture exist?”

Since this is a book about people, it is inherently also about culture. We are all bitcoiners. Almost every woman who contributed to this collection uses bitcoin, helps others learn about bitcoin, owns bitcoin, or contributes directly to the open source projects that make up the bitcoin ecosystem. Sometimes we do it under our own names. Sometimes we don’t. A few women in this collection are involved with cryptocurrency projects beyond bitcoin. Yet they also contribute to underlying research and software development indirectly related to bitcoin.

Throughout three years of reporting on “the space,” I’ve observed and participated in a variety of bitcoin cultures. There’s no single culture related to this software or the habits associated with it. Some bitcoiners, like Nigerian lawyer Faith Obafemi, don’t consider themselves anarchists even if they are cypherpunks. Other contributors to the anthology are more heavily influenced by punk ideologies.

Many women who contributed to this collection have wildly different political, religious, and professional backgrounds. We can’t even agree on whether to capitalize the word “Bitcoin.”

While this book does not attempt to define “bitcoin culture,” it offers accounts from a variety of different user groups. This collection offers a peek at a few voices across the ecosystem that might not be loud on Twitter or on stage at a conference. Plus, bitcoin often reveals its true value in our most private moments.

As such, this book is meant to be shared with people who might not frequent industry spaces. For them, we’ve included brief histories related to the technology called bitcoin.

At the same time, this book is also for any crypto veterans who are curious to hear about fellow bitcoiners beyond their known circles. Many of the anthology’s contributors have shared their personal experiences and perspectives on the technology’s evolution. Rather than fitting any particular stereotype, it’s clear that bitcoiners come in all shapes and sizes.

Many of the contributors to this anthology have a high level of technical skill. However, we wrote this book in a style simplified enough for almost any age and level of digital literacy. Whether it is a short poem or the ancient history of cryptography and timestamps, we hope everyone can find a piece here that clarifies a few little truths and terms related to bitcoin.

Where I fit in

Beyond the intention of this anthology, some readers might be curious about its lead editor, myself. (Shout out to Michael McSweeney and the mysterious BitcoinStripper, both of which also contributed editing to this collection.)

I’m a journalist who first learned about bitcoin in 2015 while working with a team of darknet experts trained in elite Israeli military units. They taught me a little about how to use Tor to investigate illicit activities. My manager assigned me a quick story about people buying drugs with this digital currency called bitcoin.

The idea of digital money intrigued me. Not because of the criminal activity, but because of all the other ways I could play with this idea of programmable value in my head, some sci-fi geek version of SimCity behind my eyelids.

After five years working in the Middle East, I initially moved to New York to work as a sex writer. I covered the porn industry, sexual health, gender issues and pop culture. Fast forward to 2017: I’m still living in New York but now working as a tech reporter at Newsweek Media Group. The editor asked if I could help spearhead a new beat focused on fintech startups and blockchain technology.

I still had no idea what bitcoin really was or how it worked. But I was willing to research it until we could make some sense of how to report on it. Several years and a hard tumble down the rabbit hole later, I’ve come to see bitcoin as a tool that could be used to encourage social change. Like any tool, the way its potential manifests in the real world depends entirely on how we wield it.

Personally, I think bitcoin could be useful for journalists who work with teams across borders. We confront all sorts of challenges, whether working as editors in charge of distributed teams or freelancers receiving payments. Reducing friction for such payments subverts the power dynamics between groups involved in international coverage, such as reporters and marginalized subjects like refugees.

Journalists can switch from selling stories about disenfranchised groups to creating stories with them that they can also earn income from, through skilled work. This improves the ethical constructs of production and the quality of the content itself.

That’s just one example. There could be many ways to use bitcoin today as a tool for social change beyond the media industry. In this anthology, we’ll attempt to answer the underlying question: How do we use bitcoin as a tool for social change?

The answer is simple: However the hell we want.

Allie Eve Knox is an erotic performer who has been accepting bitcoin for work in the adult industry since 2014. She moved most of her assets into self-custodied bitcoin solutions in 2017 and joined the crypto startup SpankChain, a payments and camming platform that has introduced hundreds of performers to cryptocurrency.

Why I Use Bitcoin

Bitcoin, for me, hasn't been about shit posting on Twitter and flexing my maximalist muscles. It hasn't been about shitting on other coins and projects in the space either. It has strictly been about getting paid in a safe and quick manner.

That’s what bitcoin is to me. It is the money I use to put food on the table, not to stroke my “hard money” ego.

When I finished graduate school in 2014, drowning in student loan debt, I entered the sex industry as a cam model. I started performing in porn later on and eventually became a fetish content producer. I’m good at my job and people want to pay me well for it.

But I kept getting shut out of the economy. My PayPal, Cash App, bank accounts, and almost every other peer-to-peer processing account got frozen and banned. I used these accounts to sell panties, custom videos, and accept tributes. So I tried Coinbase. It took very little time to hold the QR code up to my webcam so members could send me payments. This quickly became my primary payment solution.

Then in 2015, the producers for a Showtime show called “DarkNet” interviewed me about using crypto for sex work. I explained bitcoin payments mean no chargebacks, and the member can stay completely anonymous if they choose.

When the show aired in 2016, Coinbase saw me flashing the QR code on TV and talking about how I was violating their “no sex work payments rule.” Then they shut my ass down, too.

So I started using a variety of different wallets and exchanges. When the market went fucking nuts in the winter of 2017, I cashed out about a third of my bitcoin and built my dream house. I was able to pay off all of my debts as well. Bitcoin changed my life and I'm looking forward to the next wave. Someday, I’ll sell my remaining holdings and retire on a beach somewhere.

Until then, the plebs send me bitcoin then beg for more of my craft. I use bitcoin because it is mine to control, and I’ve always been a bit of a goddess who masters her own universe.

Linda Xie is the co-founder of Scalar Capital and was previously a product manager at Coinbase. She came across Bitcoin in 2011, joined Coinbase in 2014, and has educated many newcomers on bitcoin over the years.

Bitcoin 101 Explainer

I’ve used bitcoin for online purchases, as a store of value, and also as gifts people really appreciate.

Personally, I really like the idea of using bitcoin as a store of value. The idea that there's a percentage of your wealth that can’t be tampered with, inflated or confiscated, is a nice type of security to have.

My family came from China and I always heard stories about why they immigrated to the US. I remember when it came to show-and-tell in school, I asked for a family heirloom to show my class and my parents had to explain we didn’t have any because the government in China confiscated everything from them.

It’s important to know not only the power that governments have over people, but also that governments change and you don’t know what will happen down the road. This is why bitcoin is valuable to me.

How has being involved with the cryptocurrency industry changed your life?

Because bitcoin is so global, I’m constantly talking to people all over the world on Twitter and Telegram. So that’s changed my perspective on things to be more global.

In some countries there is high inflation, so people look at bitcoin from an anti-inflation perspective. In other countries, people with unreliable banking services might see bitcoin as a way to access investment opportunities. Some people are even just okay with it being “magical internet money” like a research project or a hobby.

The more I’m in the space, the more I think we shouldn’t just be pushing the narrative of bitcoin as internet gold. It can be a lot of things to a lot of people.

The different uses of bitcoin

Bitcoin is a decentralized digital currency. I think part of what makes it difficult for people to understand bitcoin is that it can serve a variety of purposes and mean different things to different people. It can sound like a panacea, which leaves newcomers skeptical. People are often attracted to bitcoin due to a combination of the following properties, some of which overlap.

- Decentralized: Bitcoin is a global peer-to-peer network. There is no centralized entity controlling it, which means that there is no central operator that can be shut down, censored, or that can charge fees. - Permissionless: Anyone can own bitcoin. There is no requirement in the protocol that you must live in a certain location or belong to a certain group. This is in contrast to the fiat financial system where there are many people without bank accounts or who are excluded from both capital markets and basic services, like decent loan options.

- Censorship resistant: No one can limit what you do with your bitcoin. If you want to conduct a transaction, the network will process it. If a government wants to take away all of your money, they can’t just seize it, unlike with bank accounts. Laws differ based on jurisdiction so what is legal in one country can be considered a crime in another. This is becoming more relevant as we see stricter capital controls in some countries.

- Transparent: There is a known supply of 21 million bitcoin that can ever exist in the world and that no one can manipulate. This is extremely appealing to those who do not want any government to have the ability to arbitrarily print more money. Citizens in countries experiencing hyperinflation are often brought up as beneficiaries of this characteristic.

- Global: No one country owns bitcoin, and bitcoin isn’t limited by the physical borders of any country. As more companies start hiring remote workers from around the world, this form of money ensures that it can be sent to anyone in the world.

- Efficient: The technology powering bitcoin is a lot more efficient than much of the financial infrastructure that exists today, at least in terms of time and how many middlemen need approval or fees along the way. Wall Street sees the potential and has begun to both push the “blockchain not bitcoin” narrative and work on permissioned ledgers. In capital markets, settlement costs eat into margins, so there has been talk about security tokens improving efficiency.

- Fast: Right now, it can take several days for your money to transfer. Banks are only open during standard business hours so, if you need money to arrive during off-hours, you could be out of luck. Bitcoin allows someone to send and receive payment quickly.

- Cheap: It’s relatively cheap to send bitcoin to anyone in the world compared to the fees that you’ll have to pay through other services. Remittances is an often-cited example of where there can be major fee savings. The Lightning Network (layer built on top of bitcoin) can enable micropayments so you can envision tipping someone a small amount for valuable content like a blog post or paying for mechanical turk-type tasks.

- Digital: Everything is moving online so it makes sense that our money does too. As virtual reality starts becoming more popular, the current generation of kids is growing up more familiar with interacting and transacting digitally.

- Immutable: This is the idea that the ledger is not subject to change or manipulation. This is critical for transfer of value, whether it’s a payment or a gift, since you don’t want someone to just be able to arbitrarily revert their transaction. Immutability can also be important in the context of tracing goods through a supply chain.

- Hedge: Bitcoin is becoming increasingly viewed as a digital gold and a hedge against global uncertainty as the asset starts becoming less correlated to traditional assets. Even institutional investors might find this appealing as a hedge for their portfolio.

Note this is not a comprehensive list and alternative terms are sometimes used instead. One person’s ranking of what is important to them can be entirely different from another person’s ranking. This has led to heated debates, but I think the different ways bitcoin impacts people is what makes it so powerful. There is no single target user for bitcoin.

Bitcoin has many attributes that serve a variety of purposes. When you talk to people about bitcoin, you’ll often hear different stories, so for newcomers it’s hard to grasp what it should be used for. For example, many early bitcoin adopters were attracted to bitcoin because it is decentralized, permissionless, and censorship resistant. An institutional investor may like the idea that it provides a hedge against uncertainty for their portfolio while someone sending a remittance might just care about it being global, fast, and cheap.

In the end, bitcoin is valuable as long as it is useful to people and it is clear that there are many groups all over the world that could benefit from these attributes.

Lisa Neigut is a hacker, plus alumna of the Recurse Center and the Etsy Android team. She’s currently the newest core contributor to Blockstream’s open source Lightning implementation, c-lightning. You can find all of her musings on topics like debt, software, and bitcoin at basicbitch.software.

A Technical History of Bitcoin

There’s a bit of an inside joke about bitcoin, a deep nerd signal, one that I happened across early in my bitcoin journey.

The joke is bitcoin isn’t a blockchain; It’s a timechain.

Origin story

The bitcoin whitepaper, Bitcoin: A Peer-to-Peer Electronic Cash System, lists eight references. One of them is Blockstream CEO Adam Back’s 2002 paper on HashCash, another is a link to the incredibly short b-money proposal. Then there’s this reference that on the face of it doesn’t really seem to fit in — S. Haber and W. S. Stornetta’s 1991 paper, How to Time-Stamp a Digital Document.

Haber and Stornetta were cryptographers working at Bell’s Communications Research group in the late 80’s and early 90’s. They put out a number of paper collaborations on timestamping and eventually built a company together, Surety, based on their research ideas. Surety was the first public timestamping service, which means it offered digital proof a specific version of a document or transaction happened at a specific time.[1]

How to Time-Stamp a Digital Document is an attempt to solve a major conundrum in the Digital Age: Is there a way to prove the existence of a particular version of a document at a specific point in time? As more and more documents have been created and manipulated digitally, the ability to timestamp a digital document has become crucial to legal investigations such as the Kleiman v Wright case.

In a world of deepfakes and remixes, how do you prove the authenticity of a digital document? The solution, Haber and Stornetta proposed, was to publicly publish a hash, or a unique identifier for each document that you want to timestamp.

These hashes would be chained together, forming a timechain.

What's a hash?

One way to think about a hash is as a short description of a larger document. Oftentimes, you’ll see this as a jumble of letters and numbers. A hash is produced by taking a document, or really any digital information, and running it through a bit-tumbling function, like a trash compactor for software. The output of this trash compactor is a set of bytes of a specified size. For example, the SHA-256 hashing function always creates a hash with a size of 256-bits.

Hashing allows computers to identify specific versions of digital documents using just a small series of letters and numbers. For example, if you take the Satoshi whitepaper PDF and you run it through the trash compactor known as SHA-256 (each trash compacting function has its own name and gives different outputs), you get the output: b1674191a88ec5cdd733e4240a81803105dc412d6c6708d53ab94fc248f4f553.

(You can confirm this for yourself at home if you’ve got a Terminal app. Download the whitepaper pdf, and then run shasum -a 256 /path/to/whitepaper on a Mac.)

The trash compacted, or hashed, version of the document is typically much smaller than the original. It also has a very high likelihood of being unique. The only way you could get the same hash would be by hashing the exact same document again.

If you were to go back in time and try it again with the original document, send the document through the trash compactor again, you should get the same hash result every time. But if you modify that document in any way and then send it through the trash compactor, you’d get a wildly different hash as a result.

Keep in mind that you should only compare outputs from the same hash function (or trash-compacting machine, to stick with the metaphor). Bitcoin tends to use the SHA-256 quite a bit.

This building of secure and useful hash functions is one of the problems that cryptographers are currently working. And this is a non-trivial project. There’s a number of properties that only a good, certified, cryptographic hash function will have. One, a good hash function gives wildly different results if the input changes, no matter how small the change. Because it’s so difficult to get these properties right, most software programmers are discouraged from building their own hash functions. It is safer to use a tested and vetted hash function, often one that has been built by a cryptographer themself.

Another property of a cryptographically secure hash is that the hash itself reveals nothing about the document used to create it. In other words, if I give you a hash of a document, it would be impossible for you to reconstruct the document that it came from. If you have the document, you can create the hash for it. You can reach this answer. But if you have the hash, you really have no way of knowing what document created it. You can’t reverse engineer it for the original question. This is a nice property, because you can publish a hash of a document without needing to reveal any of the information in the actual document.

In fact, this is the key insight of the timechain.

A timechain seeks to make hashes public and to label those hashes with a timestamp. Together, the hash plus the timestamp serve as proof of a document existing at a certain time, without needing to make the document itself public.

You can use Twitter as a timestamping service, for example. As an example, let’s say that I hash every email that I write to my friend Lacy. Before sending the email, I tweet the hash out. Later, let’s say that Josh decides to sue me and Lacy about a patent idea. I need to prove that I had emailed Lacy my idea before Josh’s patent application was submitted. Because of the timestamps on the tweets, I can prove the existence of an email that will verify my claim of having had the same idea months before Josh did. Putting the same information through the hash compactor will still result in the same record from before, without needing to keep the contents of that tweet or email. Timestamping hashes of documents is very useful!

But a tweet is not a great place to publicly put hashes of documents. Twitter, the company, could delete my tweets. Or a malicious insider at Twitter could alter the database, changing the hash that I had originally posted. Haber and Stornetta’s timechain was a way to solve this problem.

Before Bitcoin

Haber and Stornetta proposed two ways to protect public hashes from alterations. One of which you’re probably already familiar with, as it looks exactly like the bitcoin’s block creation and chaining mechanism. In fact, it is the bitcoin block chaining mechanism. Haber and Stornetta proposed a “blockchain” as a way to prevent anyone from altering past hash entries to the timechain.

How does this work?

The core idea of the timestamping service is to take a bunch of hashes, e.g. from documents that a law firm or a corporation needs to prove existed at a certain time, then bundle them up and publish the hashes in batches.

Instead of publishing each hash for every new version of a document as it’s created, these bundles are only published once a week. With this, you can prove that any version of any document in that bundle existed before the bundle’s publication date.

This works well enough if you trust the person publishing the timestamps. But what prevents, say, a particularly motivated defendant from bribing someone with access to the central server to change the publication date on the document batch? Or, more generally, how can we trust the stamped time on the original batch, without having to rely on the integrity of the central timestamping service? This is where Haber and Stornetta's chaining comes in. If you chain all of the bundles together, then you at least can guarantee that the chain link was created at least before the next one. By publishing all of the links in the chain, you have a definite, provable order for the creation date of those batches of documents.

Haber and Stornetta proposed to chain these batches together in the following way.

First, create a single hash that describes all of the document hashes in the bundle. Say I’ve got five emails that I want to timestamp. I run each of them through a hash function and get a hash for each of them. Then, I take all of those hashes, put them in order alphabetically, and run them through the hash function again. After this, I have a single hash that was created from the hashes of the original documents. You could recreate this ‘bundle hash’ by repeating the previous steps.

Ok, so now we have a hash that describes the bundle. How do we link multiple bundles together?Simple: the next time you create a document bundle, you include the hash of the previous bundle in it as well. This way, it’s impossible to create a new bundle without knowing the hash of the previous one. This technique of “include the hash of the last bundle in the next bundle” is what we call “chaining”.

In some ways, it’s a bit like creating paint colors. You can’t make orange without red. You can’t make that bright orangesicle color without orange. So if I have something that’s painted in that orangesicle, you know that, at some point, the painter started with red paint. (Which then got mixed into yellow to make orange, which was then mixed with -sicle to make the orangesicle color). Chaining document bundles together follows the same logic -- you make one document bundle and run it through a hash function. The resulting hash then gets included in the next bundle, which in turn gets included in the next. When you look at the most recent bundle, you’ll know that it couldn’t have made without the previous bundles included in it.

Meet Alice

Cryptographers (and, by extension, bitcoiners) have lots of inside jokes, like just referring to blockchains as “timechains.” They all carry equally strong nerd signals. For example, blog posts, lectures, and papers about bitcoin or crypto -- all of them talk about a hypothetical transaction with someone named Alice.[2]

So let’s offer our own math problem with Alice falling down the timechain rabbit hole.

Imagine Alice’s timestamping service started on January 1, 2010. Alice is working an important court case about Satoshi’s identity, and she wants to prove the date an email was sent. She discovers that the hash of the email is included in the document bundle number #1000, for example, that was published on the timechain. What is the earliest provable time that Alice’s email existed?

To find the answer, we take the number of the document bundle (1,000) and multiply it by how often a new document bundle is produced -- let’s say that Alice’s timestamping service publishes a new bundle every 10 minutes. We multiply the number of the document bundle by the number of minutes between bundles: 1,000 bundles times 10 minutes is 10,000 minutes. Translating this, that is 6 days, 22 hours and 40 minutes. Thus, this is proof that the document existed for 6 days, 22 hours and 40 minutes after January 1, 2010, or January 6th at 10:40 pm.

Timechains to blockchains

First, Alice’s ‘bundle of documents’ is what blockchainers call a “block”. The “chain” is the exact same as in a timechain -- it refers to how each new bundle includes the hash of the previous bundle.

In fact, a timechain is made using a blockchain. Anyone can make a blockchain without making a timestamping service. The difference is that a timestamping service adds a number of guarantees that a blockchain alone can’t provide, such as the proof that a specific document existed at a specific time. It does this by publishing on a schedule.

So is bitcoin just a blockchain or is it also a timechain? Let’s walk through the facts.

The world’s most valuable timechain

The bitcoin network uses a type of algorithm known as a ‘proof of work’ algorithm, which aims to guarantee that a new document bundle is published every 10 minutes.

Every bitcoin block is a bundle of transactions. Each new block must include the hash of the previous block in the chain.

First, though, let me explain what a bitcoin transaction is. In any payment system, a transaction is a written record of a transfer. For bitcoin, what you transfer is the right to spend bitcoin; a bitcoin transaction records that right being reassigned to someone else. In other words, the person spending the bitcoin gives their right to spend that bitcoin, which then passes it to someone else. As part of the transaction, however, the person ‘spending’ or transferring their right to spend, must prove that they had the right to spend that bitcoin in the first place. This is done by including a list of previous transactions (that were included in earlier blocks) that they own together with proof that they own them, which we call a signature.

To recap, the bitcoin blockchain is a set of interlocking bundles of documents that are published on a schedule. In fact, all that the bitcoin blockchain is a timestamping service for the transfer of bitcoin values from one locking script to the next. A locking script is a Bitcoin Script program that controls who can spend the bitcoin.

Every bitcoin in the bitcoin ledger is associated with (locked to) a Script program; by providing the correct inputs to the program you can move the bitcoin to a new Script program (locking script). This is what spending bitcoin is.

One common critique of people outside the bitcoin ecosystem is that they don’t think that bitcoin provides any value, i.e.that it’s not worth anything. Although I don’t feel qualified to opine on bitcoin’s value from a currency perspective, I do believe that a globally accessible and verifiable timestamping service is incredibly valuable.

Today, bitcoin is the digital world’s most widely available timestamping service. In fact, one of the core bitcoin developers, Peter Todd, created the Open Timestamps project which is built on this very premise; his project dates records by using bitcoin transactions. Beyond money, bitcoin is also the world’s most widely available timestamping service.

Not your keys, not your bitcoin

Now that we’ve got a pretty good understanding of what a ‘blockchain’ and ‘timechain’ are, I’d like to revisit these transactions that make up bitcoin’s document bundles and see what we can uncover about the real nature of a bitcoin transaction signature. To help us on our journey, let’s check in with Alice again.

Alice is a proud bitcoin holder; Alice keeps her bitcoin in a digital wallet, which in reality looks a lot like a piece of software on her laptop, or a little plastic dongle that she plugs in over USB.

Leather wallets in the real world contain pieces of paper. These pieces of paper have numbers and pictures written on them. Other people can see how much they’re worth by looking at what’s written on the paper.

Bitcoin wallets don’t contain paper. Instead they contain numbers that act like passwords or keys. These numbers are meant to be kept secret. Whoever knows the key can spend whatever bitcoin is associated with these specific numbers on the bitcoin blockchain. That’s all that a bitcoin wallet contains -- long numbers that are hopefully 1) randomly generated (so someone trying to guess them won’t have any clues) and 2) secret. The technical term for these numbers is “private keys”.

Mapping private keys

Every private key has a unique, partner number[3]. This is called the public key. Public keys are what bitcoin gets locked to in a transaction.

When Alice uses her wallet to send funds to her friend Bob’s bitcoin address, her wallet software is creating a new document (a transaction). This document will re-assign the bitcoin from the public key Alice controls (which has the private key for in her wallet) to a public key that Bob controls (tied to the private key for in his wallet).

This bitcoin transaction is placing Alice’s funds under a new lock, one that only Bob’s private key can open. After this transaction is published and then included in a block, Bob, as the owner of the private key and the associated the public key that bitcoin was locked to, now has the ability to create a new bitcoin transaction to lock the value of this bitcoin to a new owner (i.e. to transfer this bitcoin to a new person).

To fully appreciate the power of private-public keys, let’s take a short trip back in time. In ancient times, before paper linen or gold coins were invented, humans had a different way of moving value around: they used to trade debts to each other.

In these times, Alice’s wallet wouldn’t be full of paper or long numbers. Instead, it’d be filled with notes saying that someone owes you something.

Let’s say that Alice grew five bushels of wheat. She gave them to her neighbor, Bob (fancy finding you here!), who in return is going to pay her 3 kitties. There’s a small problem though. Bob can’t pay Alice her kittens today -- the kitties haven’t been born yet. Since he’s got five pregnant cats, Alice trusts his ability to pay up eventually. In the meantime, she needs a record of this transaction. Something that Alice can use, perhaps, to trade for something else.

We need a way of recording this debt, some type of token that is redeemable for kitties in the future. Let’s say that they write it down on a piece of paper. Alice can redeem this paper for kitties once they’re born. This works fine as long as Alice holds onto the paper, but gets a little more complicated if Alice decides to trade her kitty paper for a new leather wallet. What’s to stop Alice from making a copy of the paper and handing it to the shoemaker as well? We want something that isn’t easy to forge and can easily prove Bob’s debt to Alice.

Alice and Bob need the ancient equivalent of a public-private key pair. Fancy math hasn’t been invented yet. Instead, they turn to the world around them.

In exitus

Bitcoin transactions are documents.

Those documents are secured by locks that correspond to a private-public key pair, much like how ancient barterers used broken tablets to ensure the unforgeability of their transactions. Instead of storing tablets in a storehouse, bitcoin transactions get submitted to the world’s pre-eminent document timestamping service, which publicly records the transaction at a verifiable time and date.

Bitcoin is a completely new invention, but it also borrows many old ideas, in some cases ones that humans have been using for millennia to trade with each other.

So time and bitcoin move on, one chain link at a time.

Image caption: Haber and Stornetta’s startup Surety used to publish the blockhash weekly in the New York Times’ “Notices & Lost and Found” classifieds.

[1] ‘Publication’ of the weekly hash result was done via the New York Times’ Notices & Lost and Found classifieds section. https://www.vice.com/en_us/article/j5nzx4/what-was-the-first-blockchain

[2]: Alice, and her buddy Bob, were first introduced in a 1978 paper by cryptographers Ron Rivest, Adi Shamir, and Leonard Adleman. This paper introduced what is now known as the RSA algorithm. You can read more about Alice, Bob and RSA on Wikipedia: https://en.wikipedia.org/wiki/Alice_and_Bob#History

[3] It’s not actually a number. It’s a point, like in algebra. Under the hood, when you tell someone a public key, you’re giving them an x-coordinate and a y-coordinate. You can concatenate (or link) these together and get a long number. So calling it a number isn’t wrong, it’s just not actually exactly what’s going on.

Jordan Kong is a VP at Atomic, a startup studio based in San Francisco, and a Polychain Capital alum. She has participated as a hackathon judge and mentor at ETH Denver and has given talks on the importance of product thinking in crypto. You can find her on Twitter at @ImNotJK.

3 Quick Facts about Bitcoin

I know his much is true about bitcoin

I first learned of bitcoin at a tech startup job fair.

“Oh, you’re an economics major!” he said, “What do you think of bitcoin?”

Over time, bitcoin came to mean many different things to me.

First and foremost, it seemed like a natural extension of the internet —especially for those of us who recognize how archaic the financial infrastructure in the US has become. It was clear that national sovereignty and state lines meant less and less as the world progressed further with free trade agreements. Internet giants were (and continue) providing services to consumers in nearly every continent. If Facebook was borderless, why shouldn’t money be as well?

For me, it took a long time to grok the 21 million cap on the amount of bitcoins in existence. It went against everything I was taught about currencies and economic growth. For better or worse, the deflationary nature of bitcoin has driven bitcoin enthusiasts to hold on to it and not spend it. So-called hodlers trade off between consumption today and consumption in the future, creating the underlying drivers of Bitcoin as a “store of value.”

In today’s world of peak consumption, what’s the purpose of a currency designed for delayed consumption? Modern currencies have all followed an inflationary model — as the economy grows, the money supply also increases in order to support the growth of economic activity. (On the other hand, modern currencies have also always been administered by a central authority, but that’s a topic for another essay.)

Here’s the rub: Bitcoin is a new kind of asset, unlike any other we’ve had before.

It is not a security, currency, or even a commodity (even if laws define them as such). Attempts to apply existing frameworks to Bitcoin has proven to be a fool’s errand. There is a plethora of metrics put together to evaluate cryptocurrencies, almost all of which are unreliable or just plain misleading. Bitcoin’s history is littered with those who have valiantly attempted to “value” the currency and issue price targets (usually without a timeframe, either).

So where does that leave us? Here’s what I know needs to be true for Bitcoin to thrive:

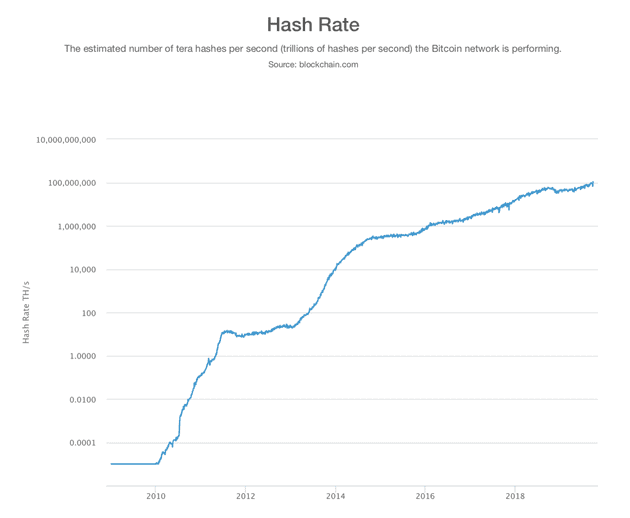

- Mining Hash Rate

Miners’ hash rate represents the sunk cost in the Bitcoin network leading up to this point and also the miner’s belief in the Bitcoin network looking forward. The Bitcoin hashrate, the amount of power fueling the global network, has continued growing tremendously since 2010.

- Fiat On-Ramps

Let’s face it: the vast majority of economic activity is done in fiat currency. What’s relevant here is the ease and accessibility of fiat-bitcoin exchanges, a key factor in increasing liquidity. On-ramps, the ways people get bitcoin with fiat, can take many forms such as:

• cryptocurrency exchanges (e.g. Coinbase, Bittrex, etc. This includes, but isn’t limited to, the use of “stablecoins” like PAX and Tether, etc.) • consumer applications (e.g. Lolli, Earn.com, etc.) • earning bitcoin (e.g. direct wallet transactions or marketplaces like OpenBazaar)

- Regulatory Limitations

Bitcoin is as much a technological innovation as it is a societal one. Regulators may not have the tools to fully control Bitcoin, but they can certainly significantly hamper it. The direction that law-makers and enforcers take could make the difference between a world where bitcoin is widely utilized and one where bitcoin remains a niche means of exchange on the black market.

Anita Posch is a bitcoin enthusiast and educator. She is the host of the Bitcoin & Co. podcast and a board member at the educational nonprofit Bitcoin Austria, established in 2011. She translated both volumes of "The Internet of Money" by Andreas M. Antonopoulos into German. She started her tech career in 1999 as an entrepreneur working with clients like the Vienna University of Economics. She holds a degree in urban planning from the Technical University of Vienna. The following excerpt was translated into English from her German-language book for bitcoin beginners, Bitcoin & Co.: How to safely buy, manage and keep cryptocurrencies.

How Do I Get Bitcoin?

Basically, there are different methods for acquiring bitcoin. Most of us will purchase bitcoin, or any other cryptocurrency like monero, at an online exchange. However, one can also earn bitcoin, just like any other currency, through work like selling a service or a product.

The current price of one bitcoin is calculated from an average price of multiple exchanges. There's no such thing as a single, true, official bitcoin exchange rate. This is why you will see different rates at each exchange. If more transactions are made, such volatility decreases. If more people buy bitcoin (in other words, if bitcoin is in demand), but the amount of bitcoin in existence (supply) is limited, the price goes up. This is how the laws of "supply and demand" impact bitcoin’s price volatility.

One question I’m often asked is: Who gets the euros when you buy a cryptocurrency?

The trader or the exchange where you swap the money earns a proportion as a brokerage fee. Ultimately, though, it's the "manufacturers" of the coins (i.e.the miners who sell their minted bitcoins for euros) that earn fiat for them, i.e..

Some years ago, it was possible for the average user to mine bitcoin with just a home computer. Now, however, the required computing power and electricity costs are so high that mining is only profitable on a large scale, with special high-performing machines and low electricity costs. There are some products that still allow users to mine small amounts at home.

As such, some mining pools tell cloud options to individuals, letting users pay for the right to some of the freshly mined bitcoin. This is like a timeshare, where you pay for digital real estate but instead of a vacation home it’s a bitcoin mining rig earning you straight profits. You don’t have to shoulder the costs of the machines or upkeep. If you choose to mine this way, the profits from mining will then be paid out proportionately.

How can I buy bitcoin with cash?

There are thousands of bitcoin ATMs around the world. Austria, in particular, has a high density of bitcoin ATMs compared to other countries. In Germany, you will find less ATMs because laws related to bitcoin are less clear and well-known. You can purchase bitcoin or other cryptocurrencies like ether, litecoin, and dash at some of these cryptocurrency ATMs as well.

Before you can exchange euros to bitcoin at an ATM, though, you need to install a wallet on your phone. For the machine to know where to send your money, you hold the QR code of your bitcoin address up to the camera of the machine.

Depending on the country, you can sometimes use an ATM to purchase several hundred euros worth of cryptocurrency, even if you don’t have an ID.

There are also two-way machines, where you can exchange cryptocurrency for fiat currencies, like a regular ATM where you can withdraw euros from your account.

Beyond bitcoin ATMs, there are also bitcoin-style vending machines that accept but don’t dispense bitcoin. For example, in Switzerland, you can even use bitcoin to buy tickets for the Swiss federal railways at a regular ticket-vending machine.

Karima Williams is a bitcoiner who has helped orchestrate community events for groups like Planned Parenthood, Women in Blockchain DC, and ConsenSys. She co-founded one of the biggest cryptocurrency meetups in Washington D.C., the DC Crypto Club.

Interview with a Black Cypherpunk Woman

When did you first discover bitcoin?

I first heard about it in 2015 because my friend was trying to buy stuff on the Silk Road spinoff. But I didn’t do any research about that and I tapped out. Then, in 2017, I heard about it again on Twitter. My friend was into it, so I bought some. Once I started, there was no going back. I started to invest. It was my first investment. It was exciting.

My family has real estate investments, but not any other investments. My mom would flip houses, but no stocks or anything like that. There were a lot of predatory loans given in the black neighborhood where I lived. After reading the bitcoin whitepaper, it kind of felt like a remedy to the broken system I knew. I thought the transparency was really cool.

Within a month, I owned 15 different coins. That was counterproductive, and I learned that eventually. Then I got involved with the Ethereum community. Having someone explain to me in person how blockchain technology works, at these Ethereum meetups, was really imperative to my learning. So I started hosting my own meetups. There’s a lot of people interested in building on Ethereum. Developers and traders would come to my meetups, so I’d learn from them.

Lots of people see Crypto Twitter as a domain of white male trolls. What’s been your experience participating in Crypto Twitter for the past two years?

I’m not completely against the libertarian guys and how they feel. But as a black woman, my body is still being policed and I want the right to my own body. For me, this isn’t a bitcoin problem. This is a deeper social problem. I want to be in control of my own life, but there are a lot of factors playing into that.

This is a people problem. Not a money problem. The money will help. I feel like I’m so behind when it comes to learning about cryptocurrency. I wasn’t exposed to anything financial until adulthood. Of course some black people know about it, but it becomes an internal class struggle. Crypto Twitter was a way to break through all that.

There was a group of black friends that met through Crypto Twitter then created a group chat from 2017. We still talk almost every single day. We know that this is important for the future. We all started somewhere, and they know that their progression is also my progression. It was inspiring to see how much we can learn. It was like having a family who didn’t want to see you make bad investments. They would tell you “that was dumb,” so you didn’t do it again. We know we have each other’s back. It helped me stay confident in crypto, keep learning and growing.

There’s always been a place for me in the bitcoin community. I never questioned that.

What was it like joining a crypto company for the first time, while pregnant no less?

It made me think: who do I want to invest my money in? People with a lot of money invest in people more than ideas. I feel like a lot of times people don’t bet on black people. They don’t think we can do it. This has been a really great experience, to show myself that I can do it.

It was a hard transition, but I can do it. I want to work with cryptocurrency and educate people about cryptocurrency for the rest of my career.

What will you teach your first son about bitcoin?

We’re going to teach my son about bitcoin from the beginning. I didn’t ever know where the money came from before bitcoin, the Federal Reserve, all that shit. We’re going to teach him where money comes from and how power structures impact us.

Look, when I think of a cypherpunk, I imagine someone who knows cryptography and is more technically inclined. Someone who probably doesn’t look like me. But if the definition of a cypherpunk is someone who uses technology to try to impact social change, then I’m definitely a cypherpunk.

What did you learn about economic independence and freedom while studying bitcoin?

People start to gain their sovereignty when they get bitcoin. They start to think about what empowerment means in the context of upward mobility. When I saw bitcoin, and I knew it would change everything, I decided to go do what people weren’t doing.

There’s so much opportunity when it comes to bitcoin, even with the steak dinner bros. With bitcoin, no one can stop you from getting it. Once you get into it, it’s really up to you. I love this about bitcoin. I want to make sure people know about this opportunity.

Amber Scott is a bitcoin maximalist. She also happens to be a Certified Anti-Money Laundering Specialist (CAMS), Certified Information and Privacy Professional (CIPP), plus a Certified Bitcoin Professional (CBP) who has an MBA. She has been an active contributor to bitcoin community events and programs for over five years, in addition to the work she’s done helping exchanges and brokerage firms serving bitcoiners.

Why Bitcoin? A Compliance Geek’s Love Story

Genesis block

When I first heard about Bitcoin/bitcoin, I thought that it would quickly become worthless.

As a compliance geek, I was primed to assume that it was a risky experiment that governments would inevitably shut down. I also had doubts that much social good could come out of a pseudonymous person or group. I was primed to see the risk, but not the potential.

Fortunately, I had also studied enough science and math to question everything. The truth isn’t always obvious.

One day in 2013, I got a call from someone running a payment processing company offering services to a bitcoin exchange, which had become a significant portion of his clientele. He wanted me to update their anti-money laundering (AML) risk assessment, which is the document some companies must have in order to show that they understand how their business could be used to launder money or to finance terrorism. This assessment must also detail steps they’ve taken to prevent such misuse.

Even though I trusted this client, I hesitated, because I didn’t have in-depth knowledge about the Bitcoin network. I’m the type of person who really needs to get my hands dirty in order to understand something well. So I asked him to pay my retainer in bitcoin. He agreed.

The far-reaching impact this single question had on my life seems surreal in retrospect.

He said I would need to provide a wallet address and learn how to secure the wallet before he could make the transfer. This was a Thursday. He would call me again on Monday. How hard could it be?

Falling in love

So, I started reading. By the time I went to bed early the next morning, my mind was still racing. That Friday, I cancelled meetings and dodged calls. I cancelled all my weekend plans. My hair was a greasy mess. My brain was twisted into even more complex knots that usual, overwhelmed with possibilities that surround bitcoin.

By Monday, I didn’t (and still don’t) grasp Bitcoin in its entirety, neither the currency nor the network. Yet learning about it was a lot like falling in love, if there’s a kind of love that also makes you learn about economics, operational security, politics, history, and yourself in very quick succession.

When the client called, I knew I wasn’t ready to “secure” my bitcoin, but I was ready to try.

At the time, bitcoin was trading at about $100 CAD, so I promptly transacted and bought myself a treat (rather than hold an asset I couldn’t secure).

In the meantime, I used exchanges to learn more about how bitcoin works. I needed to keep getting my hands dirty. I have no regrets about any or the things that I needed to do to learn.

Soon, I reached a point where learning on my own wasn’t enough to help me fully understand how other people were thinking about and using bitcoin.

It wasn’t long before I started going to bitcoin meetups at the old Decentral on Spadina Avenue in Toronto. At first, I just wanted to listen and absorb everything. However, I also ended up working with a few bitcoin exchanges and brokerages in the process. Plus, I met some incredible humans that I am lucky to call good friends.

In my experience, bitcoiners are the most welcoming and generous community that I have ever been fortunate enough to work with. People have been so patient with me, willing to answer my questions and help me learn.

Was it the Spider-Man comics that repeated the idea that ‘with great power comes great responsibility’? Interacting with the Bitcoin network taught me so much about that concept. I wish I could say that I got it right away, but that would be a lie. I’m often convinced that even now, I only see the tip of the iceberg. Nonetheless, I like what I see.

Mistakes are inevitable

Like most bitcoiners, I made (and continue to make) plenty of faux pas along the way. In the spirit of not taking myself too seriously, here are some of my favorites to date:

• In 2014, I told an acquaintance that litecoin had a ‘better’ price than bitcoin. • I was once so miffed at the idea that there would only ever be 21 million bitcoins that I blurted out: “That’s just code - it can change.” • I’ve dabbled in day trading cryptocurrencies. Some people have fun and make money at this, or so I hear, because I am not one of those people. • I completely failed to understand the importance of recovery seeds until I bricked a device. • I’ve politely kept my mouth shut and listened to many blockchain “use cases” and “utility token” pitches that didn’t make any sense. (Don’t worry, I’ve since become far more vocal.)

When it comes to mistakes related to bitcoin, I’m sure some of you have been there too. Maybe some of you are there now, and you know what? That’s ok.

Part of the reason that Bitcoin is brilliantly fun and equally terrifying is that there is always more to learn. Whenever I think that I have a solid grasp on a core concept, I’ll have a conversation that turns my understanding on its head. Or I’ll see a tweet that sends me on yet another research mission. I’ve since become leery of certainty and experts.

Building on bitcoin

These days, my research goes far beyond how bitcoin works and how to help businesses use it in a compliant way. I’m also fascinated by all the tools and services and structures that can be built on top of Bitcoin.

Back in 1997, there’s no way I could have predicted that today I could cheaply use the internet to connect to a wide world of humans, a repository of knowledge, a spectacular array of entertainment, and so much advertising. In a similar fashion, I can’t predict what will be built on Bitcoin. But I expect it to be epic.

I consider myself a Bitcoin maximalist. I don’t mean that I think all other cryptocurrency projects are malevolent (though some are) or that all blockchain projects are scams (though some are). I consider myself a Bitcoin maximalist because I believe Bitcoin (and its native token bitcoin, aka BTC) is the most secure, valuable, and useful project that I’ve seen in a long time.

Generally speaking, there are very few finite resources. Chief among these are time and BTC. So, if my time is limited, I want to spend it in a way that adds the most value to Bitcoin by working on Bitcoin/bitcoin-related projects, which have proven to be some of the most rewarding work in my career.

Self-custody

To understand how much bitcoin means to me, we need to get personal for a moment.

I had a tough childhood. It included one of my parents robbing me repeatedly. She stole the wages I earned in my first jobs—babysitting, then waitressing. My bank account was repeatedly drained without my knowledge or consent. When my bank told me that I didn’t have rights, I went to a new bank, and that history repeated itself.

So I started cashing my checks instead. Then that parent became abusive. I was beaten for my money instead of having it withdrawn from the bank; this at least seemed more honest.

And I’m not the only one to be told by a bank that I don’t have rights. Some of my friends and family are former refugees who fled their homes, leaving everything to avoid genocide and persecution. They were also told that they don’t have rights to what they left behind: homes, possessions, and bank accounts.

In some cases, even before they fled, it was illegal for my friends to hold bank accounts in their home countries. The right to self-custody was not honored for people of their gender, race, or religion.

Now imagine a form of value that carries rights in the core of its code. That’s bitcoin. It’s the power of complete financial sovereignty. This idea is so immensely hopeful. Sometimes, I’m still in awe of the very idea that humans were tenacious enough to dream it and bring it into being.

I’m in awe of the immense will that it must have taken bitcoin’s inventor Satoshi Nakamoto to remain pseudonymous and calm, to hand this creation over to the users.

The creation of bitcoin strikes me as an act of brilliance without ego. From the need to constantly learn to the need to separate social acceptance from money, participating in Bitcoin is itself an act of humility.

Compliance and bitcoin

Yes, I’m both a bitcoin maximalist and a compliance geek. Those two loves are not mutually exclusive.

People who argue that bitcoin can be used for illegal activity are merely trapped in circular arguments.

That risk is an absurdist trap they’ve chosen to apply selectively. From cars to shovels to belts to banks and cell phones—just about every object can be used to do something illegal, or even dangerous.

BTC is just a tool. And just like cell phones, illegal or dangerous activity is not what most of us do with our tools. There is a balancing act to working with Bitcion. The trick is being smart about how the business mitigates risk. We also need to consider Bitcoin’s potential for good.

So far, we haven’t done a great job of considering the social good bitcoin could promote in the world. Modern societies are scarred by decades of well-intentioned laws that have mostly deepened class divides and silenced dissidents. More than anything else that I’ve experienced in my adult life, Bitcoin is a chance to do better.

We as bitcoiners can imagine ways to do better, from lofty goals (financial sovereignty) to the mundane use cases (settling international payments quickly without fretting about a bank). I’m ready to take that chance.

Josie Bellini is an artist and designer who has been creating cryptoart since 2017. She creates art that tells the story of the crypto ecosystem: a story she is uniquely positioned to tell with her background in finance and her passion for technology. Not only does Josie utilize canvas and paint in her work, but she also releases digital art and augmented reality scenes to fully immerse her viewers. She now exhibits artwork at conferences across the country such as Consensus, NFT NYC, and Satoshi Roundtable. You can learn more about her work by following her on Twitter at @josiebellini and visiting her website https://josie.io/.

A Bitcoin Art Manifesto

Before starting my bitcoin journey, I worked in private wealth management serving high net-worth individuals.

I was helping rich people get richer by managing assets that were not available to ‘non-accredited’ investors, a.k.a people like myself who aren’t millionaires. These definitions don’t take into account an individual's qualifications, knowledge, or freedom of choice.

I witnessed and participated in a system designed to help people with means and bar those with none from gaining the same wealth. I was ready to see change.

In 2008, the year of the financial crisis, a pseudonymous figure named Satoshi Nakamoto created a new form of money: bitcoin. It would come to be one of the most impactful forms of protest in the history of our modern, monopolistic monetary system.

Discovering my freedom to purchase an asset like bitcoin that is fair, transparent, and not connected to any single entity, changed everything for me. Not only in my personal life, but in my professional life. I began investing small amounts into the market and was soon able to make returns that helped me pay off my student loans. After paying off all of my student debt, I was able to start a savings account for the first time in my life. I knew I had to educate the people around me. I decided to create an entire brand and business to promote the broader adoption of crypto assets.

The first step, as with any movement, is awareness.

Today, I paint to earn my financial freedom and tell the story of our revolution. My paintings tell the tales of the people, technology, and history behind crypto through various art mediums like physical, augmented, and even virtual experiences. I have created a series of artworks that focus specifically on visualizing the history of the bitcoin ecosystem. They include pieces on cypherpunks, Hal Finney, Satoshi, Mt. Gox, Satoshidice, the Silk Road, bitcoin super clubs, and more.

By launching my artwork on Twitter, I stay independent of gallery representation that often pockets between 40-60 percent commission. Twitter has also enabled me to reach an international audience that I otherwise might not have been able to access.

With an increase in international collectors, bitcoin payments have become very important for my business, allowing me to easily transact internationally 24/7 with minimal fees and increase my sales. Through my artwork, I now have the means to donate to charities I care about, including Free Ross, an organization seeking to end the unjust imprisonment of Ross Ulbricht, and various aid groups that help vulnerable populations in Venezuela.

My journey to promote the adoption of crypto assets has not only empowered me to reach new heights both creatively and professionally, but has also given me a newfound appreciation for the bitcoin industry and the unstoppable people within it.

You do not have to be an artist or technologist to contribute to the growth of Bitcoin: you can simply read, research, and reach out to others. We are still in the early days of this revolution and have yet to see the full potential for change that bitcoin can have in our society.

Audrey Chaing is a blockchain analyst and cryptocurrency trader who runs blockchaing.org. She represents the State of California as part of the Blockchain Working Group, is a member of the Oakland Blockchain Developers and SF Ethereum Developers, and created the MIT Applied Blockchain Series. She has a computer science degree from MIT and an MBA from the Wharton School of the University of Pennsylvania, and is a frequent speaker at events like Google International Women’s Day and OneWorld Blockchain at Davos.

How to Make Art with Bitcoin

While I’ve seen bitcoin art out there, I’ve mostly seen pieces where the literal bitcoin symbol or coin is represented in a traditional medium like painting or sculpture. Here are some examples:

!(bitcoin)[/image31.jpg]

So I thought it would be interesting to create art from actual data or from a process used in the Bitcoin protocol. This piece goes through my journey as I examine how I might make a visually compelling work that utilizes a component of the Bitcoin protocol. As with all experiments, this one might fail. Here we go—

I start by considering a few areas where interesting art could be created.

Elliptic curve cryptography

If you have studied the underlying methods by which Bitcoin is built, you might have come across elliptic curve cryptography.

Public key cryptography is built upon elliptic curve cryptography (ECC). An elliptic curve is a plane curve defined by an equation of the form:

y^2 = x^3 +ax + b

As Wikipedia explains:

You might be familiar with the graphs of other equations such as linear, quadratic, and cubic. Bitcoin in particular uses the elliptic curve named secp256k1. According to Bitcoin Wiki, secp256k1 was almost never used before Bitcoin became popular. Because it was constructed in a special way, it often allows for 30 percent faster computation than other curves used in elliptic curve cryptography.

Here are graphs of several equations, including secp256k1:

!(Source 2: Jimmy Song)[/image38.png]

If you want to learn more about how elliptic curves are used in public key cryptography and how it is all built up starting with simple points, check out my post about the beginning of Jimmy Song’s Programming Blockchain Course.

Since graphs are inherently – graphical!, there could be some interesting art to be made with elliptic curves, and specifically with secp256k1 as the base. However, I ultimately decided to explore a different direction for this particular experiment: creating art with hashing algorithms.

Hashing algorithms

A hash function can be thought of like a black box. The same input will always produce the same output. If you change just one character of a string input, for example, the resulting hash will be completely different.

The Bitcoin protocol uses hashing to ensure that no block content has been tampered with, and to link the history of blocks together – to produce an immutable blockchain. Hashes are considered one-way functions in that it is easy to compute the output if you know the input but practically impossible to go backwards and find the input if you only know the output.

!(Source 3: Grokking Bitcoin by Kalle Rosenbaum)[/image37.png]

Bitcoin uses the famous SHA-256 algorithm. It also uses the RIPEMD160 algorithm although not everyone knows that. One interesting characteristic of hash functions is that given an input of any length, it will always return an output of a fixed length. Fixed length outputs could potentially be put together in lines to create a square or rectangle visual shape, perhaps highlighting certain characters with different colors to create a unique text. I think this sounds fun so I’ll explore this road.

I need a SHA-256 Hash Generator and this is my first search hit.

Thirteenth century meets twenty-first century

Now for the fun part – what to send through SHA-256?

My favorite poet is a thirteenth-century Persian poet known as Rumi or Jalāl ad-Dīn Muhammad Rūmī (Persian: جلالالدین محمد رومی), also known as Jalāl ad-Dīn Muhammad Balkhī (جلالالدین محمد بلخى), Mevlânâ/Mawlānā (مولانا, "our master"), Mevlevî/Mawlawī (مولوی, "my master"). This one Rumi poem about impermanence resonated with me, especially the idea that experiences – light as well as dark ones – should be welcomed graciously as teachers.

The Guest House

This being human is a guest house.

Every morning a new arrival.

A joy, a depression, a meanness,

some momentary awareness comes

as an unexpected visitor.

Welcome and entertain them all!

Even if they are a crowd of sorrows,

who violently sweep your house

empty of its furniture,

still, treat each guest honorably.

He may be clearing you out

for some new delight.

The dark thought, the shame, the malice.

meet them at the door laughing and invite them in.

Be grateful for whatever comes.

because each has been sent

as a guide from beyond.

Let’s throw this line by line as above into the SHA-256 hash generator:

961DA26E274AB4B9CFE1F2A9CF03B372BE58EDE08AC0446E9922B225671FA248

A40AAD4D18C670884A139B3D53CE04786832BBFF278F3EDB5902A923A7498674

9BF5FA69766CF4A2B5C8A70734BFDF0F712E9CBE8CB544871FB48116EF8D21B3

59A66322B23A340CA12D1CF67FA4604766021BF258232FA448C9518FF6947F95

CAB5E1D908A6248CAEDD3B8B7ECFAE5014C768B6F1F1E6CDED6C89F47EB55518

027D2DFCC810F2F0895D15910B5B51491C6FAE54CAA5AB8A59500609992A3458

E02B36C6130CC081A364E10F7400DC73C14B2AF0ACCEE78B7FB3A5487FE710F8

A4AAE98092B2AF402A7E4E67D1F7101A2A363F87976228CF045C36CAEE20907C

1FDA1E5CC053988AAD26971AF1DCB3A11CA8537BAFA245F841ADF02257C7449D

78B9B67CF2625EBCA6A87680412D6B99A2613D2C52A1E21D60F9004C44EF073D

AA01946CC7BA607C4C61DFF3DED431C0FB962BA27D841B3BA99FCCD730658E02

38C519D8ABAEA0E943C92EB3AEAC78241FD14BF4A8E0EE957FCDDDE00DCA2C82

FD75262720E8F4C2F3A859B8EA81BE15429418C01354AD31D1049C1CF455BA3B

6141FFCC4D2942B36C2FF3A8DB2F0A2E24F11B0A8185CDB9A8851C642516F9CB

63FBB4770AD00B0C4EB1FD948289785539EAF840CB497D1C006C70C6F823B433

406B4DC25D1EFBB0D620CF224DF09BE13817C835314B604404A4D4C6D6534493

74520182241CB78FEF6995C889B9DCD256FC3EA2D30A9FA6D11C0CAF479B0A86

F075DBE2C1A0362D93752D9690A5313243FEFC29C12DD9F836E3405B5879F13FOk, that doesn’t look that visually appealing – let’s justify the text so it’s evenly spaced:

961DA26E274AB4B9CFE1F2A9CF03B372BE58EDE08AC0446E9922B225671FA248

A40AAD4D18C670884A139B3D53CE04786832BBFF278F3EDB5902A923A7498674

9BF5FA69766CF4A2B5C8A70734BFDF0F712E9CBE8CB544871FB48116EF8D21B3

59A66322B23A340CA12D1CF67FA4604766021BF258232FA448C9518FF6947F95

CAB5E1D908A6248CAEDD3B8B7ECFAE5014C768B6F1F1E6CDED6C89F47EB55518

027D2DFCC810F2F0895D15910B5B51491C6FAE54CAA5AB8A59500609992A3458

E02B36C6130CC081A364E10F7400DC73C14B2AF0ACCEE78B7FB3A5487FE710F8

A4AAE98092B2AF402A7E4E67D1F7101A2A363F87976228CF045C36CAEE20907C

1FDA1E5CC053988AAD26971AF1DCB3A11CA8537BAFA245F841ADF02257C7449D

78B9B67CF2625EBCA6A87680412D6B99A2613D2C52A1E21D60F9004C44EF073D

AA01946CC7BA607C4C61DFF3DED431C0FB962BA27D841B3BA99FCCD730658E02

38C519D8ABAEA0E943C92EB3AEAC78241FD14BF4A8E0EE957FCDDDE00DCA2C82

FD75262720E8F4C2F3A859B8EA81BE15429418C01354AD31D1049C1CF455BA3B

6141FFCC4D2942B36C2FF3A8DB2F0A2E24F11B0A8185CDB9A8851C642516F9CB

63FBB4770AD00B0C4EB1FD948289785539EAF840CB497D1C006C70C6F823B433

406B4DC25D1EFBB0D620CF224DF09BE13817C835314B604404A4D4C6D6534493

74520182241CB78FEF6995C889B9DCD256FC3EA2D30A9FA6D11C0CAF479B0A86

F075DBE2C1A0362D93752D9690A5313243FEFC29C12DD9F836E3405B5879F13FThis is starting to look like a better base for art. Now I’m looking at this output and it seems I could probably color them in groups of six as hex color codes. Let’s try:

961DA26E274AB4B9CFE1F2A9CF03B372BE58EDE08AC0446E9922B225671FA248

A40AAD4D18C670884A139B3D53CE04786832BBFF278F3EDB5902A923A7498674

9BF5FA69766CF4A2B5C8A70734BFDF0F712E9CBE8CB544871FB48116EF8D21B3

59A66322B23A340CA12D1CF67FA4604766021BF258232FA448C9518FF6947F95

CAB5E1D908A6248CAEDD3B8B7ECFAE5014C768B6F1F1E6CDED6C89F47EB55518

027D2DFCC810F2F0895D15910B5B51491C6FAE54CAA5AB8A59500609992A3458

E02B36C6130CC081A364E10F7400DC73C14B2AF0ACCEE78B7FB3A5487FE710F8

A4AAE98092B2AF402A7E4E67D1F7101A2A363F87976228CF045C36CAEE20907C

1FDA1E5CC053988AAD26971AF1DCB3A11CA8537BAFA245F841ADF02257C7449D

78B9B67CF2625EBCA6A87680412D6B99A2613D2C52A1E21D60F9004C44EF073D

AA01946CC7BA607C4C61DFF3DED431C0FB962BA27D841B3BA99FCCD730658E02

38C519D8ABAEA0E943C92EB3AEAC78241FD14BF4A8E0EE957FCDDDE00DCA2C82

FD75262720E8F4C2F3A859B8EA81BE15429418C01354AD31D1049C1CF455BA3B

6141FFCC4D2942B36C2FF3A8DB2F0A2E24F11B0A8185CDB9A8851C642516F9CB

63FBB4770AD00B0C4EB1FD948289785539EAF840CB497D1C006C70C6F823B433

406B4DC25D1EFBB0D620CF224DF09BE13817C835314B604404A4D4C6D6534493

74520182241CB78FEF6995C889B9DCD256FC3EA2D30A9FA6D11C0CAF479B0A86

F075DBE2C1A0362D93752D9690A5313243FEFC29C12DD9F836E3405B5879F13FEven after bolding the text, this does not seem that interesting. Abort mission! Time for more online search. A search for “free word cloud generator” brings me to this website.

If I input the result from the SHA-256 hash, here’s what I now get. More colorful!

!(color)[image43.png]

After playing around with the built-in formatting options, there are at least a few options for artistic shapes. In the grayscale piece below, I picked the “$” sign as the “Shape” option. It doesn’t look much like a dollar sign to me but I like the form.

!(color)[image41.png]

And in the next one I picked the shape of a bank as the “Shape” option, since Satoshi’s whitepaper was released just after the financial crisis of 2008. Note that in this purple one, I decided to leave two lines off as it made a more visually interesting shape. “Every morning a new arrival” and departure, right Rumi?

The following lines were not drawn:

• 9BF5FA69766CF4A2B5C8A70734BFDF0F712E9CBE8CB544871FB48116EF8D21B3 (1) • A4AAE98092B2AF402A7E4E67D1F7101A2A363F87976228CF045C36CAEE20907C (1)

!(color)[image48.png]

Thanks for joining me in making some simple nerdy art. There’s certainly no shortage of data and processes to play around with in the world of Bitcoin.

GlitchesBrew is a writer, alt-psych dabbler, lover of defiance and new ideas, and child of the old internet at heart. While democracy-sites fell and e-culture was balkanized, cryptocurrency has prevailed beyond her wildest teenage dreams.

Currency

A bit of shiny metal. Intrinsically pretty. Rare, but more could be found, especially by the hard-working and those of keen perception. Anyone can find value in it, and a given chunk of gold could come from anyone. Finding and using it adds beauty to the human world. And there is no consensus required to make it worth looking at — but it is easily stolen, less easily faked, and there may not be enough of this metal to go around.

Regardless, this is the age in which we come to think of currency as Currency.

A bit of shiny metal. Less pretty, but still very rare — the Consensus reaches far enough to know exactly how rare, and where the deposits are. The hard-working and earth-digging are enslaved. There is minimal hope of finding enough to properly stir the economy.

Retrieving it from the earth is no longer an act of unconditionally adding beauty to the world. Fakes are difficult. Every bit may be minted identically, but each has a story and an experience, its own scratches and dents.

A bit of fancy paper. Good for one bit of shiny metal. Concern over counterfeits grows, but the government has a vested interest and only so much shiny metal to hand out. The hard-working and earth-digging denizens of the world are thrown into wars to capture resources to trade for more shiny metal. Yet there is still only so much purchasing power one can achieve by taking without giving.

A bit of fancier paper. Good for preventing the government from shooting you (for reasons codified but, for all intents and purposes, left to discretion), or for one variable amount of shiny metal, which the Consensus evaluates and nations manipulate freely. Coins exist, but with little intrinsic value, they're just metal bills.

Numbers on a server. Free of counterfeiting by the poor, but easily tampered with by the powerful, who are busy with using deficit-inflation to weaken all coffers but their own. No intrinsic beauty. No meaning. No privacy.

Then the fancier paper starts attracting suspicion. It is also prone to arbitrary theft by governmental agents. No fairness. No reliability. No chance of a new influx going anywhere but where the powerful want it go. Points in a game we're required to play at gunpoint, and nothing more. Nothing we wanted out of Currency is present anymore.

So we’ve crafted a new form through which to take power, using metal pockets and hidden fragments of paper.

Numbers on different servers. Intrinsically beautiful, a crystal slowly growing, a geode in countless GPUs. Rare, but more are found - new numbers unearthed by the day, the rich better able to afford deeper mines but anyone able to pick up a pan and sift. Finding it adds beauty to the world—more data to document the soul of mankind, every transaction and every desire thereof, so a sufficient AI may finally understand us (if it's not already here).

Currency can be beautiful again.

Governments would have to cripple their civilian tech, and their economies with it, to control where it goes like they did for their own numbers. There is little to stop a critical mass of the populace from simply walking away from Omelas.

Anyone capable of causing undue inflation would have to seriously advance the technological cause of mankind to do so. Theft is, while not impossible, usually much more complicated than taking someone's shiny metal; fakes are a non-issue, and the slow trickle-feed of "outside" money is guaranteed.

A bit of mystical software with smooth edges. Intrinsically pretty.

Does this sound more like Currency to you?

Part 2

Hannah Rosenberg is an e-commerce developer, economist, educator, and entrepreneur who teaches at both the University of Illinois at Chicago and the Blockchain Institute, where she serves as the managing director. She is the founder of Velas Commerce, a cryptocurrency business consultancy, and the organizer of Chicago’s largest bitcoin community, the Chicago Bitcoin and Open Blockchain Meetup.

Bitcoin Doesn't Care about Your Gender Philosophy

In many ways, I’m a bitcoin maximalist. I see bitcoin as very likely to be the biggest winner in the burgeoning currency wars. Most other cryptos are truly “shitcoins.” But I cannot call myself a maximalist with a clear conscience; the word is tainted. It’s been twisted and abused by those obsessed with biology.

Do you ever get annoyed when people lump two entirely unrelated viewpoints together into one “philosophy”? Why do fiscal responsibility and homophobia wind up under the same “Republican” label? Why do “civil liberties” and policing every other aspect of your life wind up in the same “progressive” camp? Libertarians might share my frustration with this.

It’s especially frustrating when this craziness, these convoluted narratives, invade your little corner of the world. For me, that corner is Bitcoin Twitter.

I fell in love with bitcoin back in 2012 and developed a strong emotional attachment to the project. Bitcoin is mine. Bitcoiners are my tribe. When you see the technology twisted, misunderstood and misused, it hurts. And when a segment of your tribe stops being able to see and connect with you, it really hurts.

I’m not sure exactly when or how it happened. Perhaps it’s a reaction to the call-out culture of the “social justice warriors” (SJWs), which itself can be problematic, and sometimes appears to disregard biology. Even so, many bitcoin “maximalists” have gone to the opposite extreme with sometimes shockingly bigoted results. Whatever the cause, there is a culture of maximalists, mostly male, where people obsess over the differences between men and women. Sometimes this obsession manifests as an inability to see beyond biological gender, sometimes it manifests as random Twitter rants about women. Many people want to lecture me, at my own events, about what it is like to be a woman bitcoiner and about the nature of maximalism.